|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Top 10 Home Refinance Companies: A Comprehensive GuideRefinancing your home can be a strategic financial move to reduce monthly payments, consolidate debt, or access home equity. With numerous lenders available, choosing the right one can be overwhelming. This guide outlines the top 10 home refinance companies, providing insight into their offerings and benefits. Understanding Home RefinanceRefinancing involves replacing your current mortgage with a new one, often with better terms. This process can help lower interest rates, reduce monthly payments, or tap into your home's equity. Types of Refinance Loans

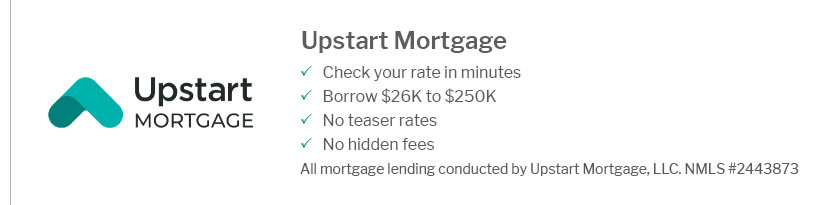

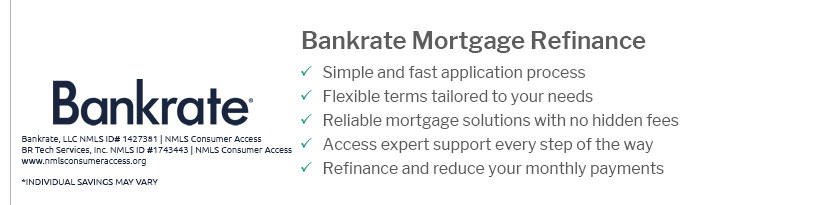

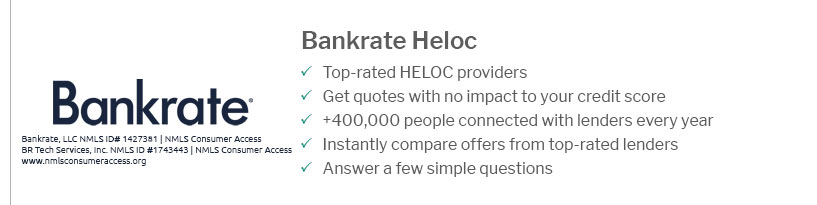

Top 10 Home Refinance Companies

Each of these companies offers unique benefits, whether you're looking for the best VA cash out refinance lenders or a straightforward rate reduction. How to Choose the Right CompanySelecting the best refinance company depends on your individual financial needs and circumstances. Consider the following: Interest Rates and FeesCompare interest rates, closing costs, and other fees. Lower rates can save you money over the life of the loan. Customer ServiceLook for companies with strong customer reviews and a reputation for excellent service. Loan OptionsEnsure the lender offers the specific type of refinance loan you need. Some specialize in cash-out options, while others may focus on conventional loans. For more insights into refinancing strategies, consider exploring the best ways to refinance home. FAQWhat are the benefits of refinancing my home?Refinancing can lower your interest rate, reduce monthly payments, allow access to home equity, and potentially save you money over time. How do I know if refinancing is right for me?Consider your current interest rate, the length of time you plan to stay in the home, and your overall financial goals. Consulting with a financial advisor can also be beneficial. What are the typical costs associated with refinancing?Refinancing usually involves closing costs, application fees, and possibly appraisal fees. These costs can range from 2% to 5% of the loan amount. By understanding the options and carefully selecting a lender, you can make the most of the refinancing process and achieve your financial goals. https://www.businessinsider.com/personal-finance/mortgages/best-mortgage-refinance-lenders

Best Mortgage Refinance Lenders - Rocket Mortgage Refinance by Quicken Loans: Best overall - Third Federal Savings and Loan Mortgage: Best for low ... https://www.investopedia.com/best-mortgage-refinance-companies-5092956

Best Mortgage Refinance Companies - Best Overall : Quicken Loans (Rocket Mortgage) - Key Specs - Best All-in-One Service : Nationwide Home Loans - Key Specs - Best ... https://www.goodfinancialcents.com/best-mortgage-refinance-companies/

Company Reviews for Best Mortgage Refinance - Quicken Loans - Better - AmeriSave - loanDepot - Bank of America - Veterans United Home Loans - Chase.

|

|---|